Maximizing Forex Trading Profit: Strategies and Insights

Forex trading can be both lucrative and complex. Traders often seek ways to enhance their profits while minimizing risks. Understanding the core principles of the Forex market is essential for anyone looking to create a sustainable trading strategy. One effective way to learn and improve your trading skills is through a reliable trading platform like forex trading profit Trading Platform QA. In this article, we will explore essential strategies for maximizing profits in Forex trading.

Understanding Forex Trading

The foreign exchange (Forex) market is the largest financial market in the world, with daily trading volumes exceeding $6 trillion. Unlike other markets, Forex trading involves currency pairs, where traders buy one currency while selling another. This setup creates opportunities for profit in both rising and falling markets. To succeed in Forex trading, one must grasp how market factors influence currency value and how to leverage this knowledge for profitable trades.

Key Factors Affecting Forex Prices

Several factors influence Forex prices, including economic indicators, geopolitical events, and market sentiment. Key economic reports, such as GDP growth rates, employment data, and inflation rates, can impact currency value significantly. Traders need to stay informed about these factors and analyze how they might affect their trading decisions.

1. Economic Indicators

Economic indicators play a crucial role in Forex trading. Reports like the Non-Farm Payrolls, Consumer Price Index, and interest rate decisions from central banks can create volatility in currency prices. Understanding how to interpret these indicators can help traders anticipate market movements and make more informed trading decisions.

2. Geopolitical Events

Political stability, elections, and international relations can all influence Forex markets. Events such as Brexit, trade wars, or geopolitical tensions can cause sudden fluctuations in currency prices. Traders must remain vigilant and adaptable to changes in the global political landscape to navigate these challenges effectively.

3. Market Sentiment

Market sentiment refers to the overall attitude of traders toward a particular currency or market. It can be influenced by news, economic data, and global events. Understanding market sentiment is crucial for Forex traders, as it can significantly impact price movements. Tools like the Commitment of Traders (COT) report can help traders gauge sentiment and make informed choices.

Developing a Trading Strategy

A well-defined trading strategy is essential for long-term success in Forex trading. Traders should consider the following elements when developing their strategy:

1. Technical Analysis

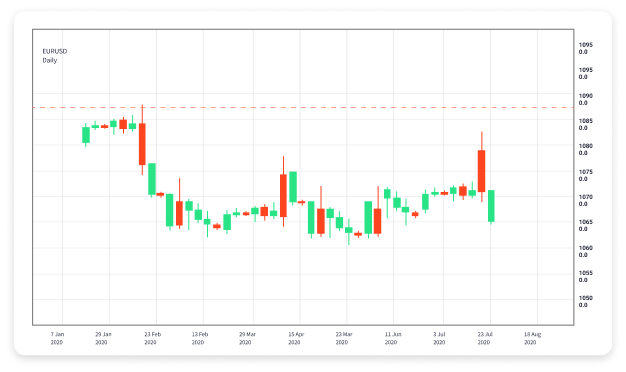

Technical analysis involves analyzing price charts, patterns, and indicators to forecast future price movements. Key technical analysis tools include support and resistance levels, moving averages, and momentum indicators. Traders who excel at technical analysis can identify entry and exit points to maximize profits.

2. Fundamental Analysis

Fundamental analysis focuses on the economic factors that drive currency values. Traders who understand the macroeconomic environment can make informed predictions about market shifts. This analysis involves studying various economic reports and how they relate to currency performance.

3. Risk Management

Effective risk management is critical to preserving capital and achieving long-term profitability. Traders should implement strategies such as setting stop-loss and take-profit orders, diversifying their portfolios, and only risking a small percentage of their capital on any single trade. A disciplined approach to risk management helps mitigate losses and manage overall exposure to the market.

Trading Psychology

Trading psychology is another crucial aspect of Forex trading. Emotions can significantly impact decision-making, leading to impulsive actions and losses. Successful traders learn to manage their emotions and stick to their trading plans. Developing a strong trading mindset involves self-discipline, maintaining realistic expectations, and continually reflecting on past trades to learn from mistakes.

Leveraging Trading Tools and Platforms

The right trading tools and platforms can enhance your trading experience and potentially increase profits. Many platforms offer advanced charting tools, market analysis, and risk management features. Choosing a platform that meets your trading needs and offers educational resources can significantly boost your trading skills.

1. Demo Accounts

Many Forex brokers offer demo accounts that enable traders to practice their strategies without risking real capital. Utilizing a demo account can help traders familiarize themselves with the trading platform and refine their skills before entering the live market.

2. Social Trading

Social trading platforms allow traders to follow and copy the strategies of experienced traders. This approach can be particularly beneficial for beginners who wish to learn from seasoned professionals and quickly grasp effective trading techniques.

Conclusion

Maximizing Forex trading profit requires a solid understanding of market dynamics, effective trading strategies, and robust risk management practices. By staying informed about economic indicators and geopolitical events, developing a comprehensive trading strategy, and maintaining a disciplined approach to trading psychology, you can enhance your chances of success in the Forex market. Additionally, leveraging the right trading tools and platforms can provide valuable support on your trading journey. With dedication and continuous learning, you can unlock the potential for significant profits in Forex trading.